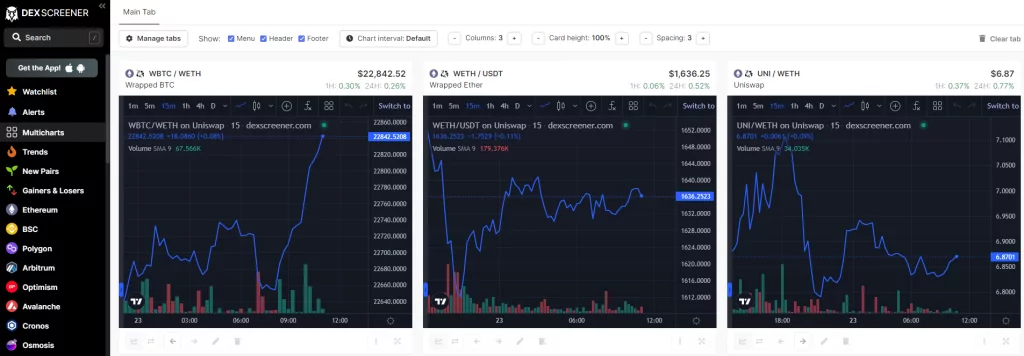

Our exploration of decentralized exchange analysis begins with the foundational tool known as DEX Screener. This comprehensive platform empowers users to track and analyze real-time data from multiple decentralized exchanges (DEXs) and chains, providing a broad overview of the cryptocurrency market.

DEX Screener tools offer essential features such as real-time market data on token prices, trading volumes, and liquidity across various assets.

With advanced filtering options, users can analyze price changes, trading volume, and market volatility. This allows you to set alerts for specific price levels or significant volume changes, facilitating proactive trading strategies.

By consolidating data from multiple sources, DEX Screener saves time and increases accessibility for traders and investors. It also serves as a valuable educational resource for beginner investors, as it helps them understand market dynamics and develop effective investment strategies.

You can filter the data to specific blockchains and decentralized exchanges. Then, you can get even more specific and sort DEX trading pairs by the number of transactions, 24-hour trading volume, liquidity and more.

For example, if we want to know what’s currently the most active trading pair on the Uniswap protocol’s deployment on the Polygon blockchain, we can easily do so with DEX Screener.

Utilizing DEX Screener tools, we can gain a deeper understanding of market trends and dynamics, which ultimately leads to more effective trading.

DEX Screener’s comprehensive coverage and user-friendly interface make it a valuable tool for both experienced and novice traders.

The main downside of DEX Screener is that it’s limited to decentralized exchanges, and doesn’t show information about other kinds of DeFi protocols like Maker or Compound.